Payment facilitator model, though more fruitful, is much more difficult to implement. Besides the financial guarantees that PayFac model requires a technical solution that would allow to handle remittance of funds to the merchants (including calculation of fees, withholding of reserves etc).

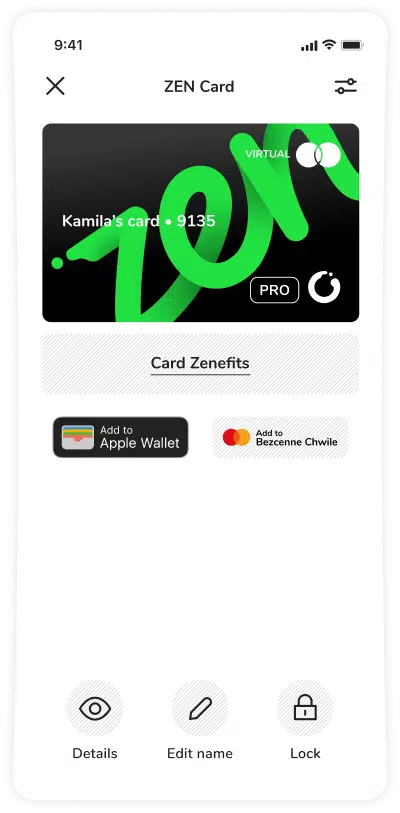

In simple words, it is a model for streamlining merchant services. Payment facilitators eliminate the need for individual merchants to establish atraditional merchant account. The payment facilitator model continues to growin popularity in the merchant acquiring field as another way of boarding merchants quickly and with minimal agitation. Also, the software provider registers with an acquirer to settle the payment services for sub-merchants.

By registering as a PayFac company with an acquirer, the software provider stands for a “master” merchant account provider, who onboards merchants on asub-merchant platform.

What is more…

Payment facilitator ignore the need for individual merchants to establish atraditional merchant account.

PayFac Implementation

Payment facilitator model, though more fruitful, is much more difficult to implement. Besides the financial guarantees that PayFac model requires atechnical solution that would allow to handle remittance of funds to the merchants (including calculation of fees, withholding of reserves etc).

Three main parties involved& what they do and are responsible for?

The acquirer, the payment facilitator and the sub-merchant.

Acquirer – works with the payment facilitator to provide the overall structure for the operation. This includes administration and underwriting process, working out apricing agreement, and facilitating the payment technology integration. The acquirer is also responsible for monitoring the payment facilitator’s compliance with operating regulations and when boarding sub-merchants.

Payment facilitator – acts as the mediator for the acquirer and the sub-merchant. The payment facilitator assumes all risk and liability for their sub-merchants.

Sub-merchants – operate under the payment facilitator in order to be able to accept payments from customers. Responsible for meeting the payment facilitator’s terms and conditions of service.

What do PayFacs do?

Payfacs open a bank account for Merchants and receive the so-called Merchant ID (MID) in order to acquire and combine payments for a group of sub-merchants. Payment Facilitators then register their master ID with a bank who acts as an acquirer in this process. Sub-merchants here are privileged because they do not need to register their individual MIDs as their transactions are collected on their behalf by the Payfac’s master MID. Such procedure was implemented to reduce the complexity for sub-merchants while setting up an online payments account on their own.

PayFac’s responsibilities

To transform your company into Payment Facilitator business is not that easy though. They have a lot of responsibilities and requirements to fulfil. PayFacs need to have full-time employees to manage ongoing payments or act as infrastructure support. They also must obtain financial institution sponsorship and undergo strict PCI audit to become fully compliant. Another requirement is both registration and annual payments to Visa and Mastercard. PayFacs are also responsible for risk analysis and management procedures for their Merchants.

Complexity

Implementation of the PayFac model into your company may be a very complex process, requiring considerable effort and following the right procedures.However, more and more platforms are becoming payment facilitators as they find this option to be more profitable.

Advantages & Disadvantages

One of the key advantages of the PayFac model is that it speeds-up the onboarding process. As a Payment Facilitator you have the power to set-upsub-merchants very quickly, they do not have to deal with complicated documentation and set up the account. Another benefit is the ability to earnmore money from network and transaction fees, thus helping the merchant with their cashflow.

While there are many benefits to this model, payment facilitators should be aware of the potential money transmission risks. This risk is greatest where the payment facilitator participates in the settlement of funds for itssub-merchants – a process that is common as it provides the payment facilitator with additional control over its sub-merchant relationships.

Is this model right for your business?

The greatest benefit is the ability to simplify and streamline the merchant account enrolment and onboarding process by offering a complete, white-label payment processing solution.

On the other hand, the biggest challenge is the level of responsibility the payment facilitator must assume. This includes greater liability for fraud, chargebacks, and data breaches, the resources to build or purchase payments technology, and the ability to meet compliance mandates and regulatory rules.

PayFac in a while

The is undoubtedly a strong possibility that the future of merchants ervices, to a large extent, is going to be shaped by payment facilitators. Ifyou are interested in payment facilitator model implementation, we solely recommend you consult the specialists, as the process is rather complicated .